News & Updates

*Press Release*

U.S. Supreme Court agrees to hear a landmark Montana religious freedom case.

Laurel, MT –Today, the U.S. Supreme Court announced its decision to take up Espinoza v. Montana Department of Revenue, a case that addresses whether states can ban religious parents and children from using neutral benefit programs because they choose a religious private school. Obviously, the court sees this as an important case. They are asked to review about 1,000 cases annually, and of those only about 70 are chosen.

“In 2015, Montana became the 46th state to adopt school choice. Now, after 4 years of non-stop litigation, we’re asking the U.S. Supreme Court to reinstate school choice so that every child in Montana can find their perfect educational fit,” says Jeff Laszloffy, Montana Family Foundation’s President and CEO. “In our opinion, this is classic viewpoint discrimination and we hope the U.S. Supreme Court agrees.”

This case arises out of a law passed by the Montana Legislature that allowed tax credits for donations to scholarship granting organizations. The Montana Department of Revenue promptly adopted a rule prohibiting religious schools from participating, saying that it would violate Montana’s Constitution. Three plaintiffs, all Montana taxpayers whose children attend private religious schools, challenged the rule in district court under both the Montana and U.S. Constitutions. They won because, according to the district court, the rule was not required by Montana’s Constitution.

In December, the Montana Supreme Court overturned the decision of the district court and the will of Montana voters. “The Montana Supreme Court found a way to strike down the Tax Credit program: it interpreted the Montana Constitution beyond its written language and then used a conflict in federal law to say its interpretation satisfies the U.S. Constitution,” says Anita Y. Milanovich, Chief Legal Counsel for the Montana Family Foundation. “Now, parents must choose to either forego their fundamental right to raise their children according to their own religious beliefs or be deprived of societal benefits and opportunities other families enjoy. The United States Supreme Court needs to address this important issue and resolve the legal conflict to protect the religious freedom of students and parents.”

“If the court rules broadly in our favor, this case has the potential to overturn century old discrimination language found in nearly half of state constitutions,” Laszloffy says, “This case is a classic example of the length of time it takes to overturn bad public policy. It took several legislative sessions for us to pass the original law, and another 4 years in court to bring it to this point.”

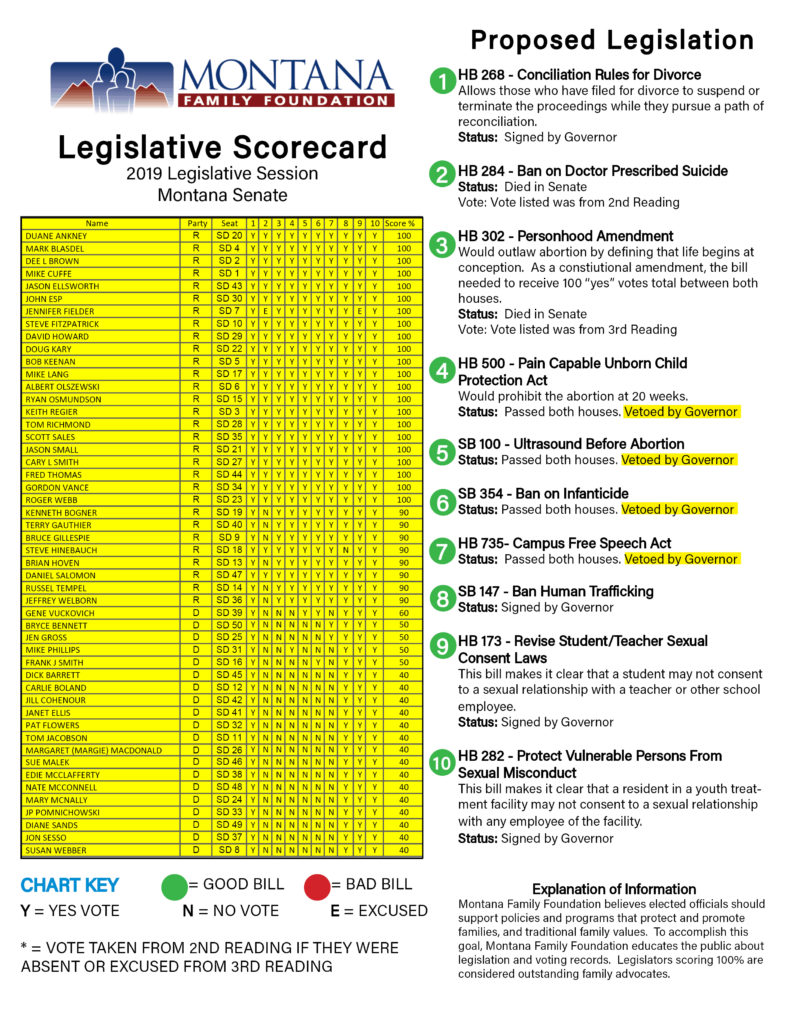

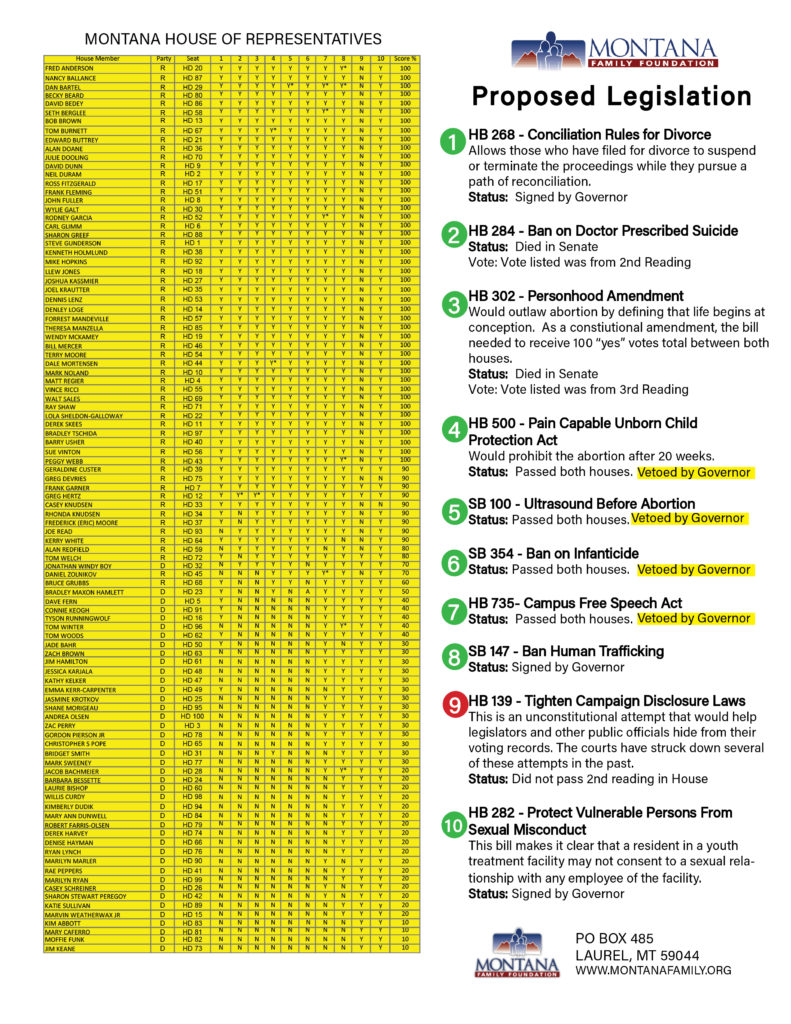

2019 Legislative Scorecard

Press Release

Montana Family Foundation files motion in Helena District Court to dismiss a three-year-old lawsuit filed by former

Montana Commissioner of Political Practices, Jonathan Motl.

Laurel, MT – Yesterday, the Montana Family Foundation filed a motion in Helena District Court to dismiss a three-year-old lawsuit on a seven-year-old complaint filed by former Montana Commissioner of Political Practices, Jonathan Motl.

Calling the lawsuit a “Political stunt that had run its course”, Montana Family Foundation President and CEO Jeff Laszloffy criticized Motl for an enormous waste of taxpayer dollars, designed to muzzle the Foundation and curtail its political involvement. Laszloffy went on to say “The fact that the Commissioner filed the lawsuit but never sent a copy of the complaint to the Foundation, never issued a summons, and let the clock run out without pursuing additional action, proves the lawsuit was a political stunt to begin with.”

“A basic requirement of any lawsuit is to make sure that those sued receive a copy of the complaint filed against them,” says Anita Milanovich, Chief Legal Counsel for the Montana Family Foundation. “The Commissioner had three years to serve those documents and the fact that he didn’t is both extremely unprofessional and troubling, and underscores concerns about the politicization of the COPP.”

The lawsuit was filed in 2016 as the result of a complaint filed in the 2012 election cycle between two candidates for the Montana senate. Ironically, the Family Foundation was never even mentioned in the original complaint. Rather, Motl unilaterally inserted the Foundation into the complaint then filed a separate lawsuit to cement the perception of serious political wrongdoing. Now, seven years after the original complaint, the window for legal action has closed and the Montana Family Foundation is asking the court to intervene and dismiss the case with prejudice, meaning that it could not be re-filed.

A copy of the Motion to Dismiss can be found here – Motion to Dismiss Doc.

Please refer any questions to Jeff Laszloffy, President/CEO 406-628-1141

Press Release

Montana Family Foundation petitions the U.S. Supreme Court in Espinoza v. Montana Department of Revenue

Laurel, MT – Today, the Montana Family Foundation filed an amicus brief supporting a petition for writ of certiorari with the U.S Supreme Court in the case of Espinoza v. Montana Department of Revenue.

“In 2015, Montana became the 46th state to adopt school choice. Now after 4 years of non-stop litigation we’re asking the U.S. Supreme Court to reinstate school choice so that every child in Montana can find their perfect educational fit,” says Jeff Laszloffy, Montana Family Foundation’s President and CEO. “In our opinion, this is classic viewpoint discrimination and we hope the U.S. Supreme Court agrees.”

This case arises out of a 2015 law passed by the Montana Legislature that allowed tax credits for donations to scholarship granting organizations. The Montana Department of Revenue promptly adopted a rule prohibiting religious schools from participating saying, that it would violate Montana’s Constitution. Three plaintiffs, all Montana taxpayers whose children attend private religious schools, challenged the rule in district court under both the Montana and U.S. Constitutions. They won because, according to the district court, the rule was not required by Montana’s Constitution.

In December, the Montana Supreme Court rejected the decision of the district court and the will of Montana voters. “The Montana Supreme Court found a way to strike down the Tax Credit program: it interpreted the Montana Constitution beyond its written language and then used a conflict in federal law to say its interpretation satisfies the U.S. Constitution,” says Anita Y. Milanovich, Chief Legal Counsel for the Montana Family Foundation. “Now, parents must choose to either forego their fundamental right to raise their children according to their own religious beliefs or be deprived of societal benefits and opportunities other families enjoy. The United States Supreme Court needs to address this important issue and resolve the legal conflict to protect the religious freedom of students and parents.”

Amicus Brief: Here

Call you Legislators and urge them to vote YES on SB 354!

Call 444-4800 and ask members of the Montana Senate to Vote yes on Senate Bill 354!